Diversifying an Investment Portfolio: How Top Investors Structure theirs

Generally we are preaching to the converted as you, as an experienced investor, will have your own rules on how to diversify your portfolio. However, revisiting the basics can sometimes prove useful in uncertain times. We have been asked by some international investors who may not have easy access to ‘the basics’ to provide a little information on how some investors diversify their portfolios. As a UK-based company we have to follow native regulations, so we cannot offer advice, however, we have gathered together some information on how some of the world’s top investors invest and have made it available for you right here.

Assessing who is the best of the world’s investors may be subjective, so we have taken personal wealth and portfolio holdings as a guide to selection. We also checked out to see if there was anything they all had in common and generally they all had a plan and stuck to it. They knew what they wanted, set themselves milestones, were self-educated and took advantage of whatever tax breaks they could. We have gathered that information together in the following section called the Portfolio Basics for your convenience.

The Portfolio Basics

Have a Goal

- A specific goal with any investment portfolio would be a specific target, such as ‘I want have £5m fund in, say, seven years’ and have a contingency plan in place just in case.

- Be realistic £5m may be achievable but is your timescale realistic from where you are now?

- Visualisation is an often overlooked key to success when things get tough – what is the fund purpose? Lifestyle improvement? Retirement? Bigger house? Faster cars? Get a picture over your desk or visit that beautiful home or car, sit in it, live it.

Have a Plan

- Having a goal with your portfolio will allow you to work backwards and make a plan of how you are going to get there

- Set milestones for each step of your plan so you can assess progress or not and break down into bite sized pieces

- What investment risks are you prepared to take or not to take? Set yourself some ground rules to start. Without rules you are likely to drift and be disappointed with your results.

Investing is not trading

- Chopping and changing investments like a trader can be costly – stick to your portfolio plan and keep fees to a minimum.

- Check your investment fund progress regularly but don’t invest in something you are not prepared to own.

- Stocks and shares are volatile short term but diversification will drive results over the long term so ensure the sector spread reflects your risk appetite.

Educate Yourself

- Never invest in something you don’t understand. Investing in yourself will always produce the best return – become an expert in your investment fund field whatever it takes.

- Diversification may be a key, however, do not over-diversify as this can dilute returns.

- Do not follow the herd make your own decisions and stick by them you’re in this for the long haul.

Tax Breaks

- Each Country is different, however, check what tax breaks you may be able to get where you live and where you invest.

- Get a good accountant if you haven’t got one already for tax efficiency.

So let’s take a look at where some of the best investors and influencers in the world invest and see if we can learn from the masters. Remember, it’s always cheaper to learn from other people’s mistakes and all these masters have made mistakes and learned from them. Learning from the masters may just save you a lot of money.

Top Investor Portfolio Structure

Warren Buffet

Warren Buffet is one of the world’s wealthiest men and is regarded as an investment genius. His personal investment performance over 60 years is astonishing, turning $10,000 into an incredible personal wealth of $86bn. This assessment is based on his Q4 filing, as per the US SEC regulatory requirements.

It is no secret that Buffet loves insurance and banking as he owns some of the biggest banks and insurers in the world such as Bank of America, Amex and Wells Fargo. Buffet also likes securities such as Bonds. His wife’s long term portfolio is 90% Equities and 10% Bonds.

Information Technology is also a significant part of his portfolio at 25.96%, however, this is in Apple shares. Consumer goods and Transport at 17% and 4%, respectively, are the next biggest investments; followed by Communications, Healthcare, Energy, Industrial and Real Estate. The investment in real estate may look small, however, it was in fact a $377m investment in Store a Real Estate Investment Trust. Whilst people were backing away from this area in July 2017 Buffet jumped in with both feet, the potential reason? Over two thirds of the real estate was service-based such as cinemas, restaurants, bowling alleys, etc.

On the face of it this may have seemed risky at the time, however, Buffet calculated correctly, as people continued to use the Real Estate services. Note, that Buffet invested via a Real Estate Investment Trust, so this gives him maximum security whilst allowing him to have reasonable liquidity when required. Direct investing into real estate is generally not regarded as a wise investment due to the lack of liquidity, however, investing via bonds and investment trusts accommodates for some more flexibility and liquidity.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” —Warren Buffett

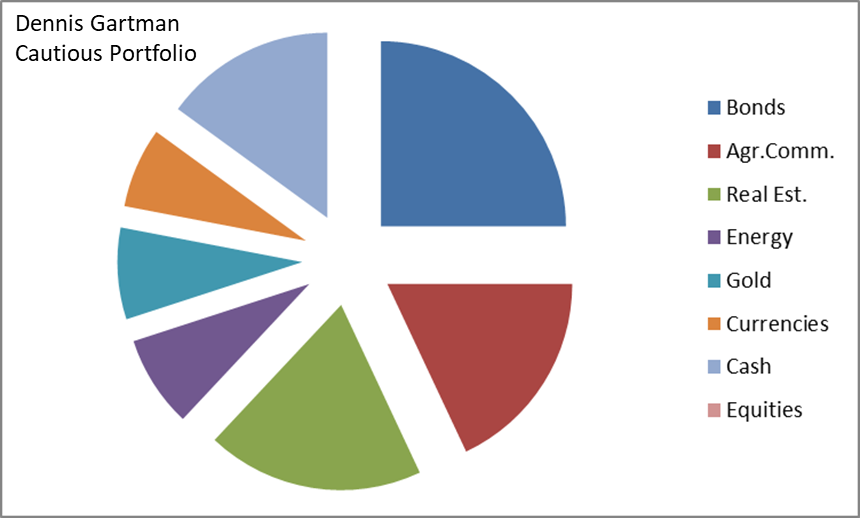

Denis Gartman

You may not have heard of Dennis Gartman, however, he is a multi-millionaire who has been a huge influencer to all the financial markets behind the scenes since 1987 when he started producing the Gartman Letter. The Gartman letter provided 24/7 financial breakdown of what happened in the previous 24 hours. The Gartman Letter was delivered each morning to traders worldwide.

Interestingly, in December 31st 2019 he predicted that a ‘bear market’ was imminent and this would hit all portfolios worldwide. His reasoning was the ‘inexperience and lack of fear’ of the traders of the day and how they would cope with a recession.

“There is always a bargain out there”, Gartman was famous for investing widely outside of stocks and shares. He argued that in a bear market when stocks and shares are falling there is value somewhere and his latest move into cautious holdings seen below reflect his concerns over the 2020 markets and include IT, Gold, Bonds, Commercial Real Estate, Cash, Energy, Financials.

“Be patient with winning trades; be enormously impatient with losing trades. Remember you only need to be ‘right’ 30% of the time, as long as our losses are small and our profits are large.” —Dennis Gartman

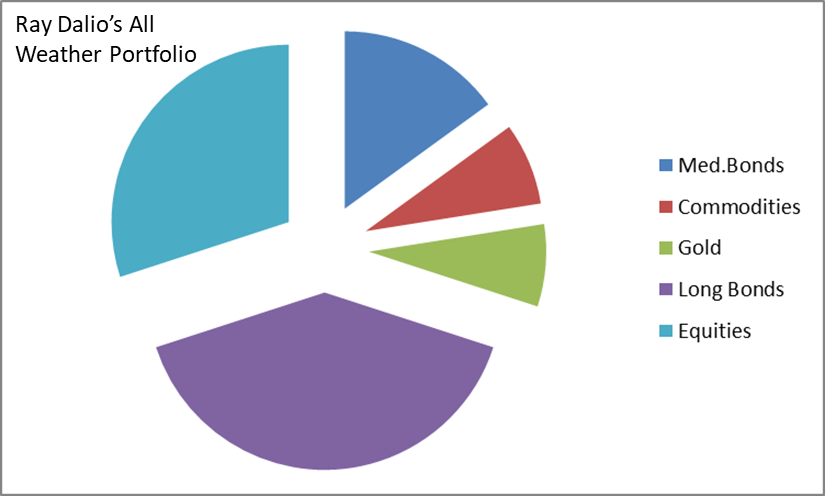

Ray Dalio

Here we have someone else who predicted the market crash this time in 2008. Ray Dalio is founder of Bridgewater Associates the largest hedge fund managers in the world according to Forbes. With a portfolio holding of $160bn Dalio has fought to make himself one of the top investors in the world. Starting out as a golf caddy he started his firm in 1974.

The All Weather portfolio was made internationally famous when Tony Robbins promoted the advice he was given by Dalio. The portfolio is made up of assets that will produce a decent performance through good and bad economic situations. However, just how well did the portfolio do? Well, it was famously back-tested by Robbins in his book and has been tested by others since. The results are quite impressive. Between 1984 and 2016 the fund averaged 12% annually and made money 85% of the time.

You would think at first sight that there would be a lot of drag on the portfolio with the bond influence, however, clearly this is not the case, longer-term.

Interestingly, Dalio constructed this ‘All Weather Portfolio’ to better most ‘economic seasons’ as Dalio calls them on the basis these are the ‘seasons’ that affect all assets:

- A Growing economy.

- A Declining economy.

- Inflation – rising cost of services and goods.

- Deflation – falling cost of services and goods.

The portfolio is constructed to perform well in any economic situation so you should see a consistent decent return over time in ‘Bull’ and ‘Bear’ markets. You will not get the excessive growth coupled with stock volatility as the Bonds counteract that giving a little drag and stability to the momentum. The Bonds ensure a low risk portfolio of course and that should be born in mind when considering your own portfolio and your age and appetite for risk.

The Gold and Commodities segments counter act the inflationary elements when they occur, so you have a well balanced portfolio for ‘All Weathers’.